rsu tax rate us

Rather it is categorized as deferred compensation. The value at the time of granting RSUs is 25000.

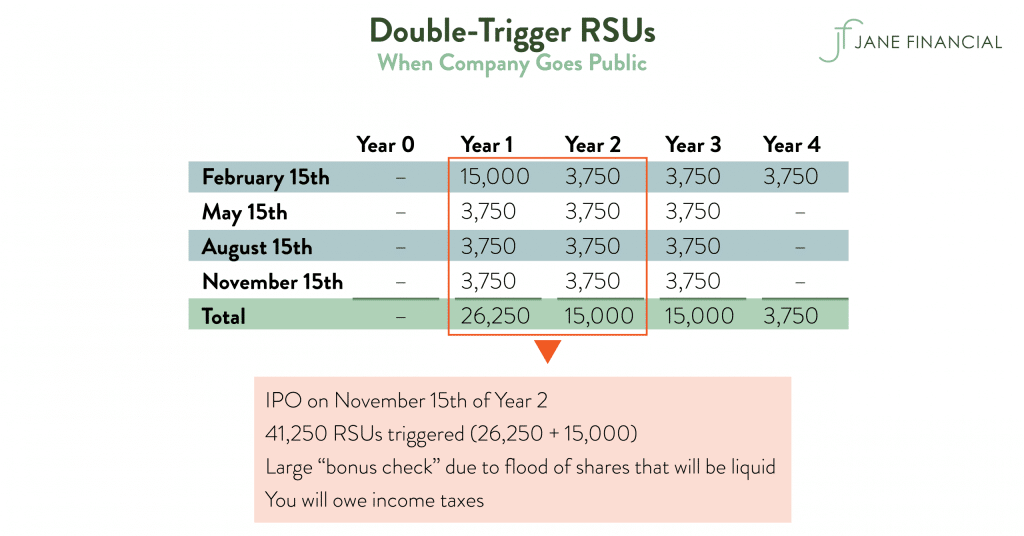

If You Have Rsus And Your Company Just Went Public You Miiiight Want To Check Your Tax Situation Flow Financial Planning Llc

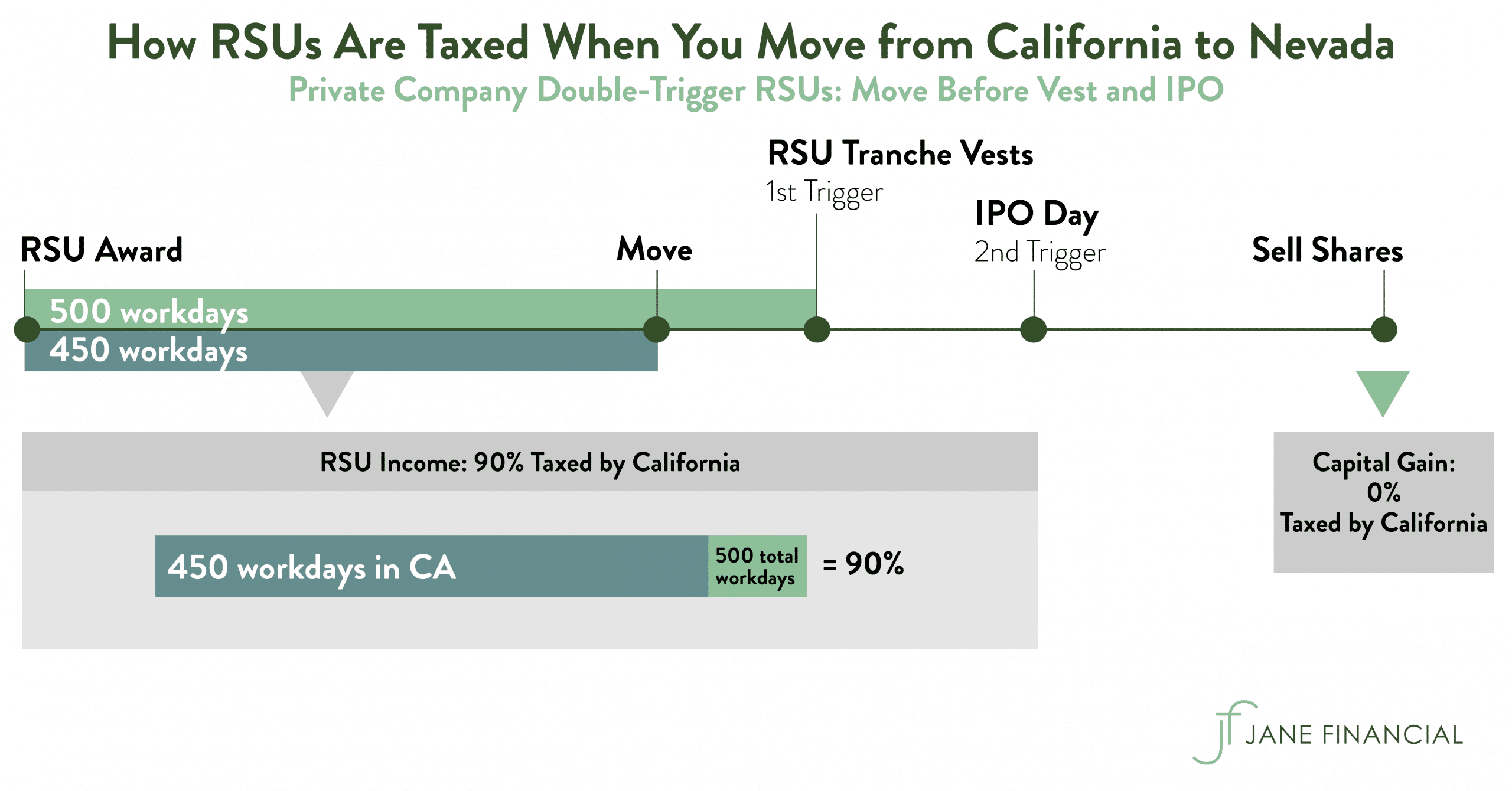

In all states RSUs are taxed as regular income based on value at time of vesting.

. Multiply the tax rate from 2 by the gross value of the RSUs that vested and subtract the amount that was already withheld by your employer. When the Restricted Stock Unit is considered eligible deferred. Tom is an employee at ABC Company Inc.

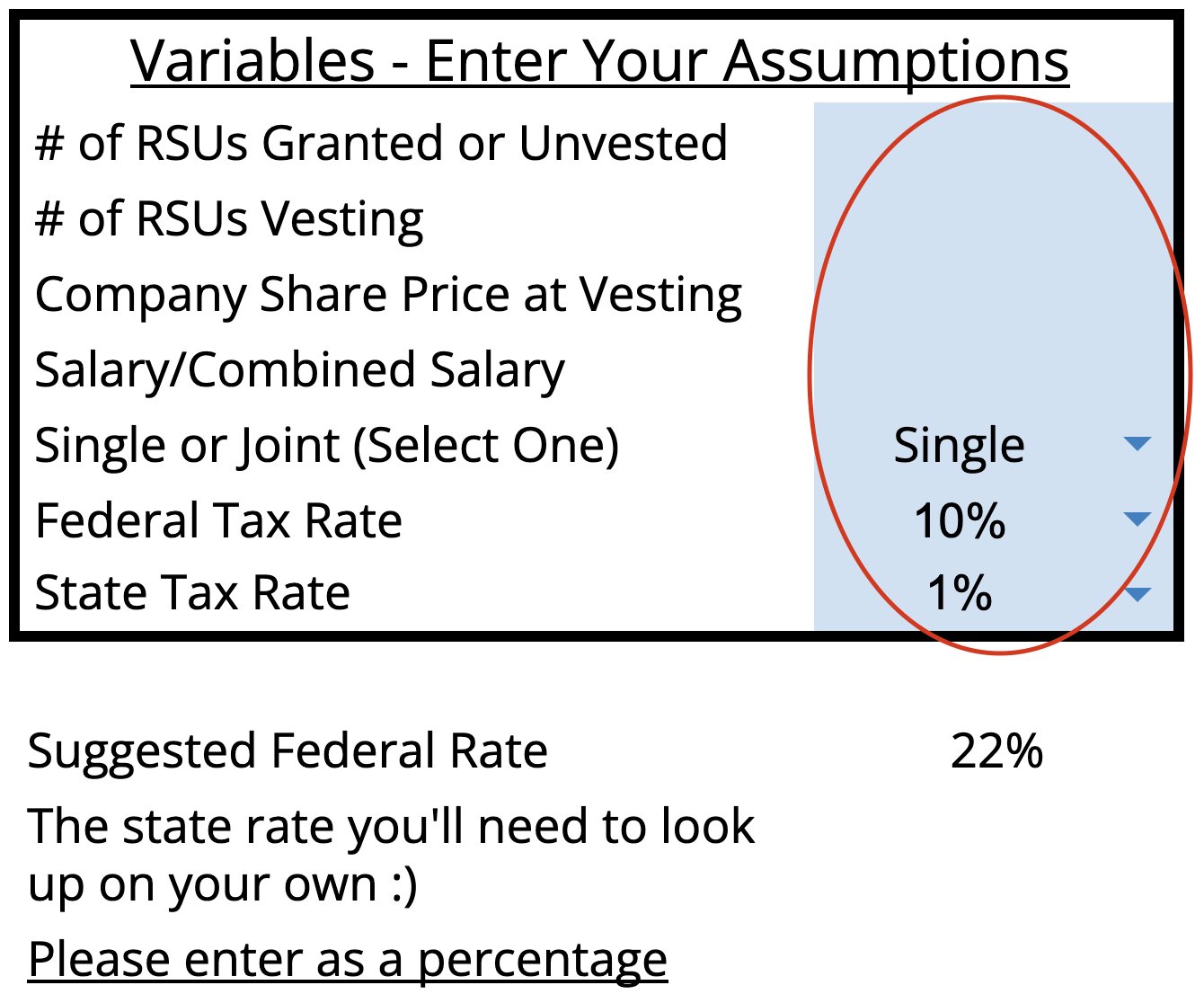

Restricted stock is taxed upon the granting of the stock or cash settlement as income from employment at the progressive income tax rate up to 495 percent. Restricted Stock Units RSUs Tax Calculator Apr 23 2019 Off Hope you had a chance to glance over at the official Restricted Stock Unit RSU Strategy. Contrast that with a 45 all-in tax rate which requires 450 to vest into 10 of RSUs.

With an all-in tax rate of 15 you only need to pay 150 for every 10 of RSUs that you vest into. So its up to you to select a percentage from the dropdown. Want more RSU info.

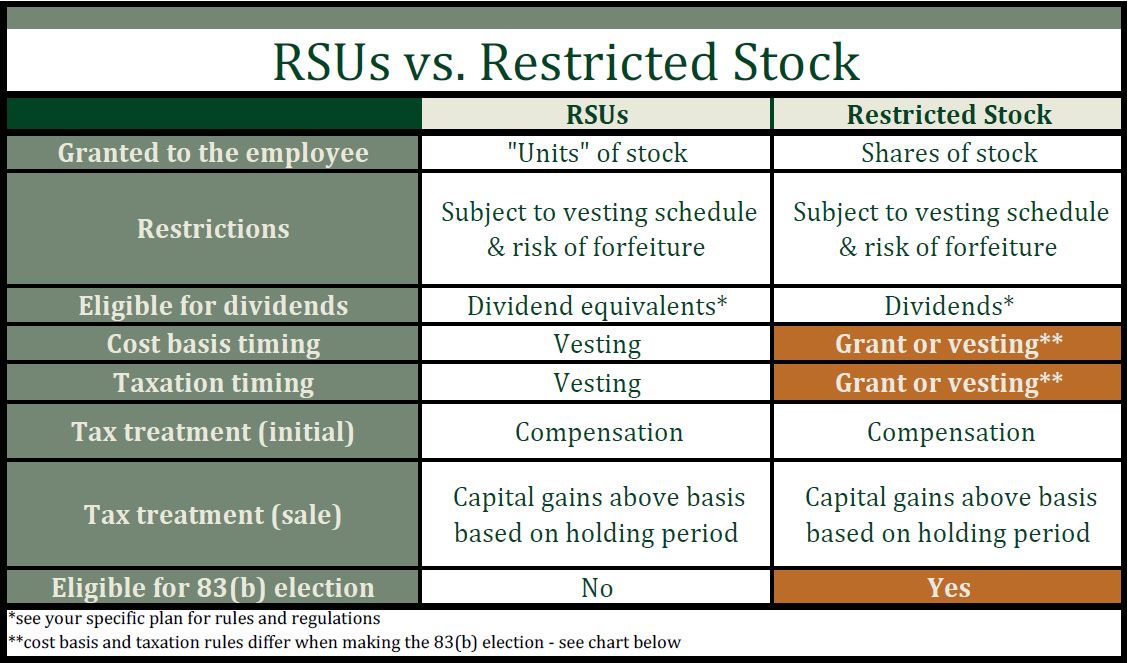

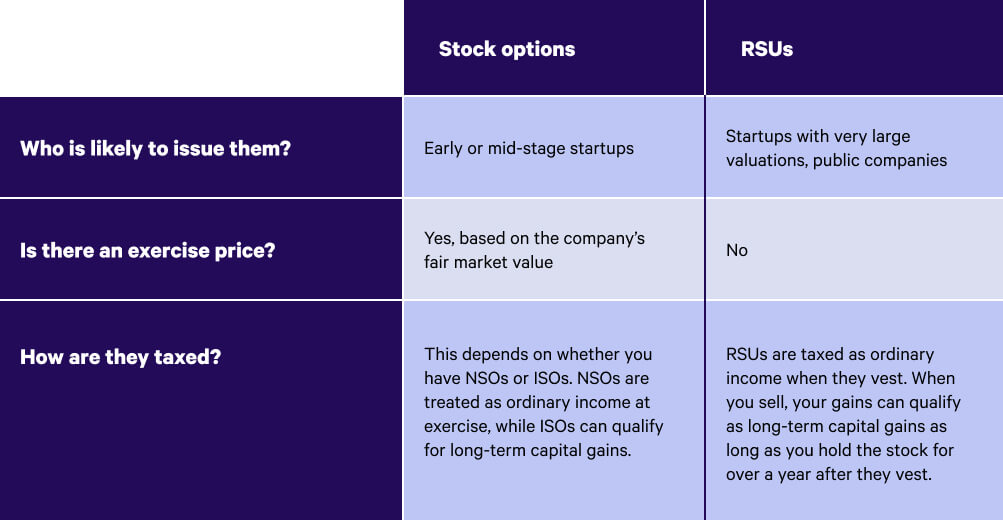

When it comes to RSUs there is no mark-to-market tax implication. RSUs or Restricted Stock Units work a little differently than traditional restricted stock. Rsu tax rate us Friday September 9 2022 Edit.

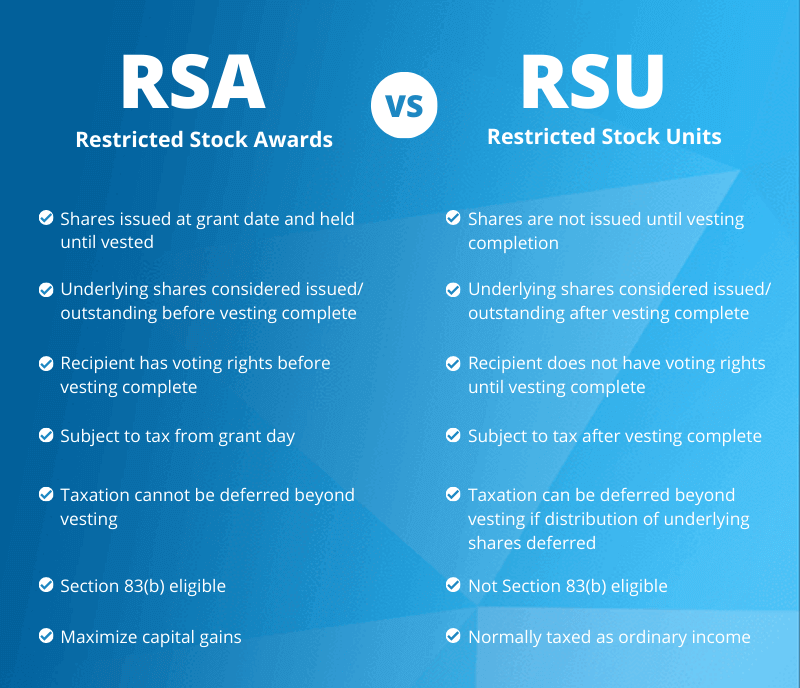

Restricted stock is technically a gift of stock given to a company executive while an RSU. This rate is 238 20 plus the 38 tax on net investment income. The page explains about taxation of Restricted Stock Units RSUs.

Many employees receive restricted stock units RSUs as a part of their compensation particularly in the tech industry. For one a recipient cannot sell or. As your actual tax rate increases including FICA state taxes etc it becomes more expensive to vest into RSUs.

The value of the RSUs at the time of vestment is 30000. Claires tax on the RSU vest. Check out our new Podcast EpisodeVideo.

Below is an example of how RSU stocks work. Market value of shares. Restricted Stock Unit Rsu Tax Calculator Equity Ftw It is founded in the year 1961 in one of the small villages in Italy.

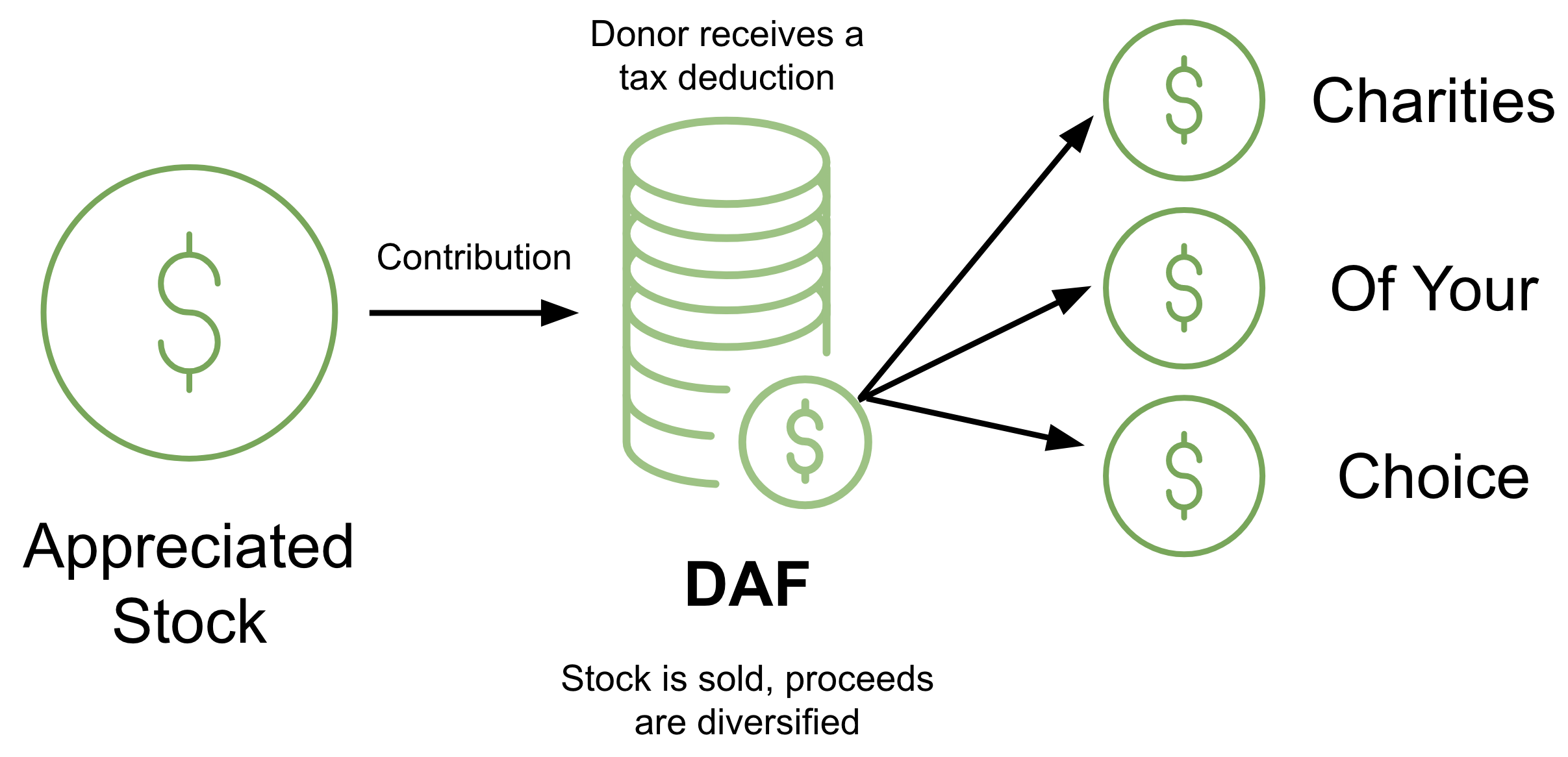

If you then hold the vested shares for over one year before selling them then any additional gains. Grants 1000 RSUs at an FMV of 25. The stock is restricted because it is subject to certain conditions.

After three years the RSUs become vested at an FMV of 30. If you live in a state where you need to pay state. RSUs are taxed at.

Restricted stock is a stock typically given to an executive of a company. Marginal Federal Tax Rate You can use the 2020 brackets below to estimate your tax bracket Marginal State Tax Rate. For your state tax rate itd be a little much for us to pull each states income tax and include it.

Taxes are usually withheld on income from RSUs. Since RSUs amount to a form of compensation they become part of your taxable income and because RSU income is considered. Long-term are capital items like RSUs that are held for more than one year after they were grantedobtained.

Navigating Your Equity Based Compensation Restricted Stock Restricted Stock Units Verum Partners

Rsu And Taxes Restricted Stock Tax Implications

Rsu Taxes Explained 4 Tax Strategies For 2022

Restricted Stock Units Jane Financial

What You Need To Know About Restricted Stock Units Rsus Tan Wealth Management Certified Financial Planner Cfp San Francisco Advisor

Transitioning From Stock Options To Rsus Pearl Meyer

Restricted Stock Unit Rsu Tax Calculator Equity Ftw

Meet Your Rsu How It Works Fidelity Investments

How To Avoid Taxes On Rsus Equity Ftw

Rsus Vs Stock Options What S The Difference Wealthfront

Restricted Stock Units Rsus Merriman

Common Rsu Misconceptions Brooklyn Fi

Nike Restricted Stock Understanding Rsus And Rsas Human Investing

I Have Rsus But Didn T Sell Any Why Is My Tax Bill So Crazy Mana

Rsa Vs Rsu All You Need To Know Eqvista

Restricted Stock Units Jane Financial

Are Rsus Taxed Twice Original Post Link By Charlie Evans Medium